Our Services

From income tax and sales tax services to company incorporation, trademark registration, import/export licensing, and international entity formation such as USA LLC and UK Ltd, we are your trusted partner for all your business requirements.

Unlocking Success Together

Your Trusted Business Solution Consultants

Income Tax

- Salary

- Income from Property

- Income from Business

- Capital gains; and Income from Other Sources

Feel free to contact our experts for further discussion.

NTN Registration

NTN (National Tax Number) registration in Pakistan is a mandatory process for individuals and businesses to be recognized by the Federal Board of Revenue (FBR) for tax purposes. It helps in filing tax returns, conducting financial transactions, and complying with tax regulations.

Filling of Tax Return

Salaried Individuals

Documents requires are:

- NTN login details(Registration # , password) if have

- Tax Deduction Certificate (Salary)/ Salary slips of FY-2023 and FY-2022

- Tax deduction certificate of Mobile networks i-e zong, Ufone etc of FY-2023 and FY-2022

- Bank Statement of all accounts(From 1st july to 30th june)

- Details of Purchase/sale of property. Tax payment Slips

- Details of Purchase/sale of Vehicle. Tax payment Slips

- Utility Bills(Electricity, Gas, PTCL, Water)

- Household expenses details.

Contact us for filling Income tax returns.

- NTN login details of AOP firm and all Partners (Registration # , password) if have

- Tax deduction certificate of Mobile networks of all partners i-e zong, Ufone etc

- Bank Statement of all accounts i-e Business account and individual(From 1st july to 30th june)

- Details of Purchase/sale of property. Tax payment Slips

- Details of Purchase/sale of Vehicle. Tax payment Slips

- Utility Bills(Electricity, Gas, PTCL, Water) of business and residence.

- Household expenses details

- Business Annual sales/Purchase details

- Business Expenses details

- Any other WHT Tax deduction certificate.

Company/Business Tax Returns

- NTN login details(Registration # , password) if have

- Tax deduction certificate of Mobile networks i-e zong, Ufone etc

- Bank Statement of all accounts i-e business/individual account(From 1st july to 30th june)

- Details of Purchase/sale of property. Tax payment Slips

- Details of Purchase/sale of Vehicle. Tax payment Slips

- Utility Bills(Electricity, Gas, PTCL, Water) of business and residential

- Household expenses details

- Business Annual sales/Purchase details

- Business Expenses details

- Any other WHT Tax deduction certificate.

Tax Return of Foreign Nationals/Non Resident

Documents requires are:

- NTN login details(Registration # , password) if have

- Foreign remittances receipts/ income receipts

- Bank Statement of all accounts(From 1st july to 30th june)

- Details of Purchase/sale of property. Tax payment Slips

- Details of Purchase/sale of Vehicle. Tax payment Slips

- Utility Bills(Electricity, Gas, PTCL, Water)

- Household expenses details

- Period of stay in foreign country.

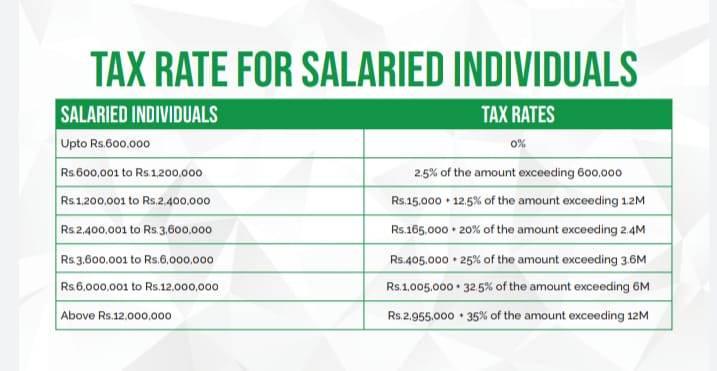

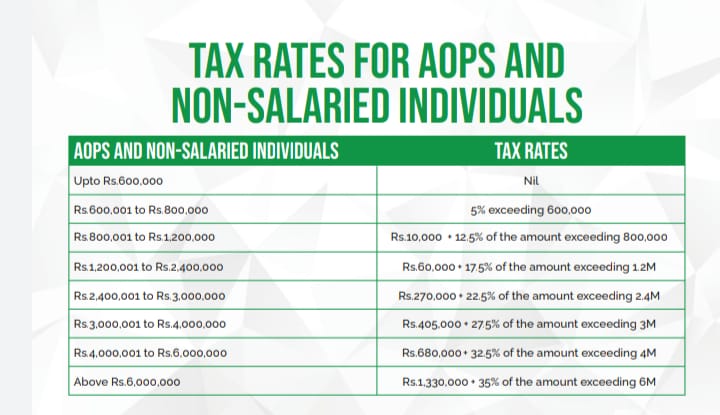

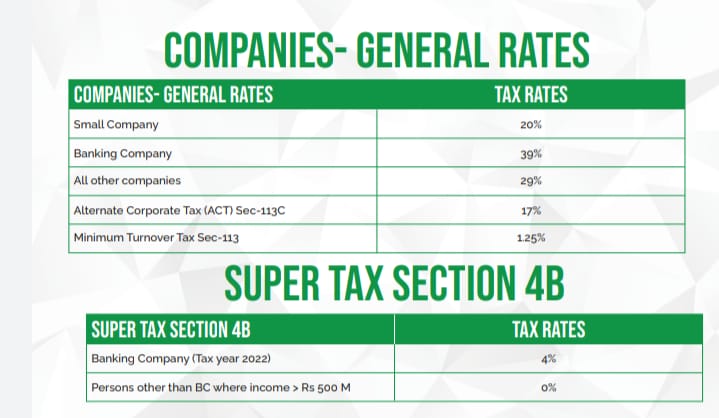

Income Tax Slabs

Sales Tax

Sales Tax is a tax levied by the Federal Government under the Sales Tax Act, 1990, on sale and supply of goods and on the goods imported into Pakistan. Sales Tax on services is levied by the Federal Government under The Islamabad Capital Territory (Tax on Services) Ordinance, 2001. We have professionals to help you to deal your sales tax matters promptly with ease on reasonable cost.

Feel free to contact our experts for further discussion.

GST Registration

Streamline GST registration with our efficient service. We assist individuals and businesses in navigating the process, ensuring compliance with the latest regulations. Simplify taxation and grow your ventures confidently.

Filling of GST Returns

Effortlessly file GST returns with our reliable service. We simplify the process, ensuring accurate and timely submissions, while keeping you updated on changing regulations. Stay compliant and stress-free.

Company Incorporation

Any three or more persons associated for lawful purpose may, by subscribing their names to the Memorandum of Association and complying with the requirements of the Companies Act, 2017 form a public company and any two or more persons so associated may, in like manner, form a private company. If only one member forms a private company, it is called a single member company.

First step towards incorporation of a company is to submit a combined or a separate application for the reservation of the Company’s name and incorporation either through e-services or in physical form as per the formats provided in the Companies (Incorporation Regulations, 2017 (the “Regulations”).

Feel free to contact our experts for further discussion.

SECP

The Securities and Exchange Commission of Pakistan (SECP) is the country’s financial regulatory authority responsible for regulating corporate entities, capital markets, and ensuring investor protection.

FBR

The Federal Board of Revenue (FBR) is the tax authority in Pakistan responsible for administering and collecting federal taxes, enforcing tax laws, and promoting tax compliance to support the country’s economic development.

Trade Mark Registration

A Trademark is a word, phrase, symbol, and/or design that identifies and distinguishes the source of the goods of one party from those of others. A service mark is a word, phrase, symbol, and/or design that identifies and distinguishes the source of a service rather than goods.

Trade Marks Registry (TMR) is the premier body of the Intellectual Property Organization of Pakistan (IPO-Pakistan) working for the registration of trade and services marks under the Trademarks Ordinance, 2001. It is a federal government body and its jurisdiction for trade and services marks lies within the geographical boundary of Pakistan.

It works as a civil court and its decisions are appealable at the provincial high courts. The Trademarks Registry is headed by a Registrar and its office is located in Karachi and also Regional Office is situated in Lahore.

Feel free to contact our experts for further discussion.

Trade Mark Registration TM-1

Secure your brand with our TM-1 Trade Mark Registration service. We handle the process, ensuring your trademark is protected and legally recognized. Safeguard your business identity today.

Import/Export Licensing

Exports and imports play an important role in determining the overall health of an economy. Countries use the data they acquire from exports and imports to determine if they are experiencing a surplus or a deficit.

Exports are the goods and services a country produces domestically and sells to businesses or customers who reside in a foreign country. This results in an influx of funds to the country that is selling its goods and services. Companies may choose to export their products and services to a foreign country because it allows them to:

- Participate in global trade

- Access new markets

- Increase revenue

Usually, companies export goods or services in areas where they have a competitive advantage over other companies because their product or service is superior. They may also export commodities they produce naturally that other countries lack based on climate and geography. For example, Jamaica, Kenya, and Columbia all have a climate suitable for growing coffee. This helps fuel their ability to export this product to foreign countries that can’t produce coffee in their region.

Imports are the goods and services a business or customer purchases from another country. This results in an outflow of funds from the country that is purchasing foreign goods and services. While most countries try to export more goods and services than they import to increase their domestic revenue, a high level of imports can indicate a growing economy. This is especially true if the imports are mainly productive assets, such as equipment and machinery since the receiving country can use these assets to improve its economy’s productivity.

For example, a paper manufacturing company in the United States may choose to import a new machine from Italy because it is more cost-effective than building the machine themselves or purchasing it from a domestic supplier. Once manufacturers install the machine, it may increase the manufacturing company’s ability to produce paper products, thus increasing their revenue and ability to export more of their goods in the future.

For those involved in the import/Export business, our team will help you to get an Import/Export license in a couple of days so that you can start and grow your business internationally.

Feel free to contact our experts for further discussion.

Import License

Simplify imports with our Import License service. We navigate the complex regulations, ensuring smooth customs clearance, compliance, and seamless access to global markets. Expand your business with confidence.

- CNIC

- Business NTN registration Certificate

- Sales Tax Registration Certificate

- Mobile Number

- Email Address

Export License

Unlock global opportunities with our Exports License service. We facilitate hassle-free export procedures, compliance with regulations, and smooth customs clearance, empowering your business to thrive internationally.

- CNIC

- Business NTN registration Certificate

- Sales Tax Registration Certificate

- Mobile Number

- Email Address

Our Process

Our Working Process

1. Make An Appointment

Seamless and Efficient: Making An Appointment for Your Convenience

2. Meet Our Professional

Meet Our Team of Expert Professionals: Experience and Expertise at Your Service

3. Your Problem Solved

Problem Solved: Tailored Solutions for Your Business Challenges

Contact Us

For more details and information feel free tocontact us via Call, WhatsApp, or email.